Why am I writing this when so much is written?

There is a sea of information available on the Goods and Services Tax (GST), including several expert views and opinions. My interest was piqued from an economic/financial, process, and IT perspective to obtain a bird’s eye view of this new change, and the more I started digging into it, the larger it continued to become (Obviously, since this has been a subject of much attention since around the time of 2009 (!!!) when the 13th Finance Commission of 2010-2015 was published under the Chairmanship of Vijay Kelkar, and even earlier from the days of the Union Budget of 2006, and the PM Vajpayee era of 2000).

The objective here is to present a simple view of GST and how it can impact the macro economy, and my observations from an ‘on-the-ground perspective’. This is a vast subject, and this article is not meant to be a treatise on GST….we can say it a ‘2 minute summary’ on GST objectives, systems, potential impact, and challenges/open questions.

What is GST? / Scope

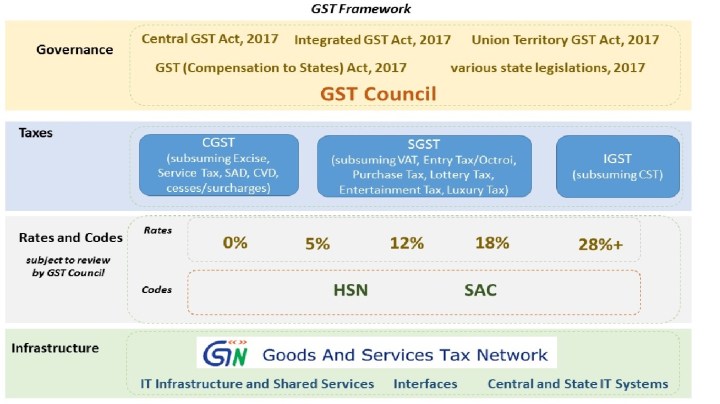

With the launch of GST, a whole host of indirect central and state levies have been rationalized into one overarching tax framework, with multiple rates based on the type of good/service. This includes several Central taxes such as Central Excise Duty, Countervailing Duty (CVD), Special Additional Duty (SAD) of Customs, Service Tax, Central Sales Tax (CST), Cesses and Surcharges, which were the exclusive domain of the Central Government; and various State-level taxes such as Sales Tax (State VAT), and others (such as Entertainment Tax, Octroi, Luxury Tax, Entry Tax, Taxes on advertising). The earlier system allowed only limited tax set-offs (such as within Central Excise Duty with respect to production). The State VAT permitted set-offs only against VAT on previous purchases. Key challenges included a web of several taxes with limited scope of tax credits and set-offs, as well as multiple records and returns. The GST came into effect from July 1, 2017, and was approved with the passage of 4 bills in Parliament, namely, on Central GST (CGST), Integrated GST (IGST), Union Territory GST (UTGST), and on Compensation to States, which were initially framed by the GST Council. With the GST, the above multifarious taxes would be replaced by a single tax, with components attributable to the Central and State Governments, and tax set-offs at each stage, with only the value addition being subject to additional tax.

While GST subsumes several taxes, it is not truly a ‘one nation, one tax’ (glib marketing??). GST does not cover several Central and State taxes, such as Basic Customs Duty (on imports), Stamp Duty, Vehicle Tax, Excise on Liquor, continuance of VAT and Excise on Electricity, toll taxes, local body taxes, road taxes, etc. It is not a truly single tax rate across goods and services (especially difficult in a large, federal set up like India). To put it simply, there will continue to remain a whole host of indirect taxes outside the GST net.

Treatment of Goods and Services

One of the key aspects of GST will be a single tax regime with different rates for good and services. These rates comprise 0% (includes several essentials, and goods in the Consumer Price Index (CPI) basket), 5%, 12%, 18%, and 28% (and cess for the last slab in certain cases) [we do not want to go into the variants of treatment and rates for various goods and services here…one can use the GST app for the same!]. Goods/Services outside the scope of GST include alcohol for consumption, crude, high speed diesel, petrol, and aviation turbine fuel.

Going forward, each point in the supply chain (from production to distribution to sales) can claim tax credits on taxes paid. For example, if a tax of Rs. 100 has already been paid on a good sold at Rs. 1,000 inclusive of taxes, and is further sold with a value addition of Rs. 500, taxable at 10%, then, in the pre-GST era, the tax incidence would have been Rs. 150 on the second leg. With the GST, the second leg in the chain can claim a tax credit of Rs. 100 already paid as tax, with the net tax after set-off being Rs. 50. The good will now be sold to the next leg at Rs. 1,550 instead of the erstwhile Rs. 1,650. Of course, if the incidental GST rate had gone up, the story can be different, as well more complicated in a system of myriad overlapping taxes with different exceptions, as also scenarios where there can be a net increase or decrease either due to changes in rates or the cascading impact of overlapping structures (to that extent, the above example is very, very simplistic).

Tax Mechanism and Credits, Registration, and Returns

As mentioned earlier, a host of taxes, which were not tax creditable (due to lack of cross-linkages or tax credits between Excise Duty paid with CST or VAT, or between afore-mentioned goods related taxes and the end delivery of services), are now tax creditable under the GST. The lack of complete tax creditability based on true value-addition led to cascading effect of taxes, in addition to complexity of returns and compliance requirements. Under the current structure, taxes slabs are categorized into:

- Central GST (CGST) – comprising the erstwhile Excise, SAD, Service Taxes, etc.

- State GST (SGST) – comprising the erstwhile VAT, Luxury Tax, Entry Tax, etc.

- Integrated GST (IGST) – on the movement of goods between states and union territories

In the case of inter-state supplies, IGST would apply, and in the case of intra-state supplies the GST rate would be split equally between CGST and SGST.

The key context here is tax credits between vendors and suppliers on the movement of the same good or service, which would be available as Input Tax Credit (ITC) across the supply chain and payable only on the ‘net’ basis (difference) subject to utilization. That said, the first level of tax credits can be claimed within the same bucket (within SGST, within CSGT, and within IGST) before being creditable across (restrictions exist, such as ITC of CGST should be utilized against CGST and IGST, and SGST against SGST and IGST, and IGST against IGST, CGST and SGST, with SGST not creditable against CGST and vice-versa) .

It should be noted that there is a requirement to register within each state where an entity does business and obtain the GST Identification Number (GSTIN), with the common linkage being the PAN of the entity. The threshold limit mandating registration is an annual turnover of Rs. 20 lakh in most states (Rs. 10 lakh in certain North Eastern states, Uttarakhand, Jammu and Kashmir, and others). This threshold is not applicable in certain cases such as e-commerce operators where no de-minimus exists, wherein mandatory registration is required. Details on registration requirements are available at http://www.cbec.gov.in/resources//htdocs-cbec/gst/regn-GST-onlineversion-07june2017.pdf.

As regards the filing of GST returns (GSTR), multiple returns encompassing transactions, verifications, and reconciliations, and annual returns are required under the GST framework. A comprehensive list of returns and associated details are available at http://cbec.gov.in/resources//htdocs-cbec/gst/returns-of-GST-onlineversion-07june2017.pdf;jsessionid=B41A8E06F1A565928DC6F7726938EB69. The strong positive is that this will be IT enabled under GSTN (elaborated subsequently).

Various aspects of GST rates have already been discussed earlier. It is to be noted that each good and service will be identifiable by the Harmonized System Nomenclature (HSN) code and Services Accounting Code (SAC) respectively. Also, note that GST will be a ‘supply’ based tax, payable at the point of ‘consumption’.

It is indeed noteworthy that there are apps provided by the Government of India, such as to determine rates and codes, as well as that there were several ‘GST Master Classes’ that were held, in addition to a large amount of officially published information (given that the current government is social media friendly)…Do visit the Central Board of Excise and Customs (CBEC) website (http://cbec.gov.in/)!

The IT Infrastructure – GST Network (GSTN)

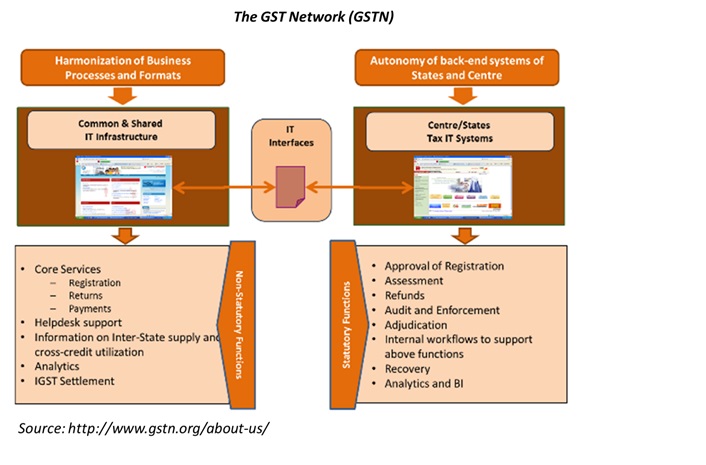

As is obvious, given the humungous necessity to capture transactions, apply tax credits, enable supply chain linkages, as well as apply tax credits, there is a need for a robust IT network. This is where the GST Network (GSTN) comes in. Goods and Services Tax Network was set up as a Section 8 non-profit, non-Government, private limited company (under the Companies Act, 2013), to provide IT infrastructure and services to the Central and State Governments, tax payers and other stakeholders for implementation of the GST in a ‘utility’ model (as a National Information Utility (NIU), 49% stake with government and 51% with non-government financial institutions, such as banks, NSE, HDFC, LICHFL, etc.).

The core purpose is well enunciated in the GSTN website…”Currently, the Centre and State indirect tax administrations work under different laws, regulations, procedures and formats and consequently the IT systems work as independent sites. Integrating them for GST implementation would be complex since it would involve integrating the entire indirect tax ecosystem so as to bring all the tax administrations (Centre, State and Union Territories) to the same level of IT maturity with uniform formats and interfaces for taxpayers and other external stakeholders. Besides, GST being a destination based tax, the inter- state trade of goods and services (IGST) would need a robust settlement mechanism amongst the States and the Centre. This is possible only when there is a strong IT Infrastructure and Service back bone which enables capture, processing and exchange of information amongst the stakeholders (including tax payers, States and Central Governments, Accounting Offices, Banks and RBI).”

Creation of common and shared IT infrastructure for functions facing taxpayers has been assigned to the GSTN across the following – filing of registration application, filing of return, creation of challan for tax payment, settlement of IGST payment (along the lines of a clearing house), generation of business intelligence and analytics. Some of these are elaborated below:

- Payment of GST using the GSTN: All challans will have to be prepared by taxpayers on the GST portal only, with payment at the portal or on presentation to relevant bank. The GSTN will provide an EOD statement of payment confirmation and reconciliations.

- Filing of returns using GSTN: GSTN will enable common return filing for CGST, SGST, and IGST, as well as for claiming Input Tax Credit (ITC), with matching at invoice level and settlement of utilization through portal.

- Registration will also be through GSTN, and it is expected that audits will be an exception rather than as a rule (say, 5% of such cases), since the ITC mechanism is driven through a system of payment, confirmation, and settlement. Another key functionality is analytics and other financial intelligence that will be available to the relevant authorities.

(On a side-note – GST: A Blockchain Use Case?: Can the future GSTN be blockchain enabled? What with Distributed Ledger Technology gaining scale and traction, where smart contracts can drive real-time linkages and credits at invoice/transaction points through self-execution, rather than leaving it to return filing processes and touch-points which seem prevalent in the current framework? This can work across the cycle of registrations, payments, confirmations, settlements, and refunds…hopefully?? More on this later – as this needs a separate discussion in itself based on user experiences, data, transactions, and issues that will arise)

Macroeconomic Impact

I believe the macroeconomic impact can be viewed from the following lenses:

- Increase in GDP: Many figures have been mentioned about the increase in GDP on account of multiple items covered in this section. Usually, estimates have suggested about 2% increase in GDP. I was not convinced about the source and basis for the estimate. Out of curiosity, I went back to where it all started – the Thirteenth Finance Commission 2010-2015, December 2009 report, and noted the background for this assumption (Chapter 5, page 65). An NCAER (National Council of Applied Economic Research) study was the origin for this estimate (‘Moving to Goods and Services Tax in India: Impact on India’s Growth and International Trade’, December 2009). This study evaluated that the possible impact of GST would be an increase in the nation’s GDP to be about 0.9% to 1.7% from current levels which would accrue every year (note that this is a range!….it is indeed good to stay away from media quoted big numbers like 2%+, x million number of jobs, etc. when they are not validated). The study estimates exports to increase by 3.2% to 6.3%, and imports to increase by 2.4% and 4.7%, thereby increasing trade balance. The study uses macroeconomic modeling and analytical frameworks such as Leontief Dynamic Theory and Computable General Equilibrium (CGE). It would be worth the while to go through these and understand the actual assumptions that went in, the recommendations made at that time, and the framework implemented eventually now (Maybe a separate blog post in itself as the devil is in the details…but, this at least helped me stop wondering ‘Where did the 2% come from? Is it 2% or 1%? Who said it? What is the basis?’)

- Reduction on the level of black money: The digitization impact of GST, viewed in conjunction with the need to ‘register’ to claim tax credits at ‘transaction level’, and the wider war on shell companies facilitated by DeMo (demonetization) can have a salubrious impact on trying to clean up the ‘system’ (read my post on ‘My Experiences with Demonitization’). I think transaction level data, IT enabled monitoring, and analytics, coupled with enforcement is critical here to address the issue of under-stating incomes…and that the mere making this data available can be viewed as a positive. We also have to view the above ‘in total’. That said, bringing in petrol, gold, land and real estate under the ambit of GST will be important in the long run to be truly effective (note that stamp duties are largely out of the ambit of GST), and that is where land and real estate comes in). This article by Arvind Subramaniam, Chief Economic Advisor, Government of India, is indeed insightful (http://indianexpress.com/article/opinion/columns/gst-gst-council-black-money-corruption-arun-jaitley-indian-economy-4551589/).

- Widening the tax base: The reduction in the exemptions permissible will help widen the tax base. There will be also pressure on vendors across the supply chain to register and become GST compliant. Usually, the black and white economy are inter-twined. A large vendor would require his input providers to be GST compliant in order to claim tax credits. Thus, potentially more such entities/suppliers/service providers would come into the system, or would need to disclose more transaction.

- Ease of compliance: The GSTN under the GST framework will simplify the many statutory requirements that earlier existed and make the process of return filing simpler (CGST, SGST, and IGST through GSTN as against many forms, many state and central authorities and multiple filings, coupled with lack of tax credits). I believe the success of GSTN will be the key differentiating factor.

On-the-ground challenges and Open Questions

My personal experiences are revealed through the following instances I witnessed during the past few weeks:

- On July 1, 2017 (GST Day!): A restaurant I visited had a ‘brand new’ menu…literally…new look and feel, new color, and at higher prices for the same items (retiring its age old menu which was in place for several years). A coincidence? Also, the restaurant was still upgrading its software and issuing manual bills…Will price benefits be passed on to consumers or businesses will use this to improve prices (tapping into inelasticity of demand at the margin)? I would view this as a wrong-way risk.

- At a food-court: Several counters had increased prices and seemed more than happy to ascribe the blame to GST, when in fact, their base prices should have come down. So much for ‘passing the benefit to consumers’….Wrong-way risk again

- During a train journey: Seated behind me in a train was the marketing team of a major child care pharma product discussing the impact of GST. They were saying they will simply ask their current vendor to be GST compliant or else change the vendor…A positive, maybe, to increase overall compliance.

- Grey markets: It remains to be seem where the Palika Bazaars, National Markets, Nehru Places, Ritchie Streets, and the Burma Bazaars of the world would go? This article makes interesting read (http://www.thehindu.com/news/cities/chennai/as-deadline-nears-chennais-grey-markets-remain-fuzzy-about-gst/article19166702.ece). In my sense, these would not vanish (and have not)…. as Jeff Goldblum says in ‘Jurassic Park’, “Life….uh…finds a way”. (https://www.youtube.com/watch?v=dMjQ3hA9mEA).

- Doomsday videos in social media: Some persons are of the point of view that the process would kill small traders due to the sheer quantum of returns that needed to be filed. While I have not seen small traders die, and I believe the GSTN and IT adoption will save the day (contrarian views may exist aplenty!).

There are many other open questions and this needs to be assessed on an ongoing basis.

My view

In my view, only time will tell about the beneficial impact of GST. No doubt, processes and compliance will be simplified having a reasonable impact. However, one cannot underestimate the ‘jugaad’ mentality of tax payers, as well as the general tendency towards tax avoidance that permeates the Indian mindset and ecosystem (refer the Jurassic Park analogy earlier). That said, we have to start somewhere, and it is always worth a try. As Robert F Kennedy said, “Only those who dare to fail greatly can ever achieve greatly.”

The macroeconomic impact on areas such as GDP, tax base, black money, etc. are the realm of deep economic analysis, cause and effect, and therefore, much remains to be seen.

There is at least one obvious benefit that is ‘here and now’…i.e., at least the compliance and accounting process will be relatively IT enabled and streamlined with an ecosystem in place (as against multiple authorities, paper bills, and manual touch-points), with a heavy emphasis on self-assessment coupled with transaction level data available for insight to users…and the relevant authorities. This IT enabled process simplification and the governance ecosystem in place, I would say, is the most welcome change to compliant tax payers/entities as regards the procedures they followed earlier and their interface with the ‘tax man’. And, there is a potential upside of reduced levels of under-statement of incomes, increase in the ease of doing business, and further streamlining and widening of the governance system (‘widening the net’).

Primarily, the GST governance framework of ITC (tax credits on value addition) across a broad range of taxes, and a supporting IT infrastructure enabling the end-to-end process are the key differentiators. For once, the law and the implementation seem relatively right (we usually get the laws supremely right and the implementation supremely wrong).

As compared to where we were earlier with myriad taxes, GST is a ‘relatively good and simple tax’ addressing sizeable anomalies (though not all). As for ‘one nation, one tax’, I would say that we are not there yet, and there is always a long way to go!!!

To close with Robert Frost, “The woods are lovely, dark and deep, but I have promises to keep, and miles to go before I sleep”.

Resources/References:

- CBEC: http://cbec.gov.in/, http://cbec.gov.in/htdocs-cbec/gst/index

- https://gstawareness.cbec.gov.in/

- GST_India YouTube Channel

- GST Network: http://www.gstn.org/

- http://www.empcom.gov.in/content/20_1_FAQ.aspx

- http://www.cbec.gov.in/resources//htdocs-cbec/gst/regn-GST-onlineversion-07june2017.pdf

- http://cbec.gov.in/resources//htdocs-cbec/gst/returns-of-GST-onlineversion-07june2017.pdf;jsessionid=B41A8E06F1A565928DC6F7726938EB69

- 13th Finance Commission Report – Chapter 5 – http://fincomindia.nic.in/writereaddata/html_en_files/oldcommission_html/fincom13/tfc/Chapter5.pdf

- NCAER Report on GST: http://fincomindia.nic.in/writereaddata/html_en_files/oldcommission_html/fincom13/Discussion/report28.pdf

Discover more from AnandWrites

Subscribe to get the latest posts sent to your email.

Very insightful Anand!!

LikeLike