Our Budget 2024 had several Schemes A, B, C – one more Scheme ‘X’ is proposed here which can do a world of good for honest taxpayers !

The STTS (Sheegra Taxpayer Tatkaal Services) Proposal – a Scheme ‘X’ for premium access for Taxpayers

Table Scheme X: STTS Honorary ‘Scheme X’ for Taxpayers by Tax Slab

DISCLAIMER: The views in this blog do NOT represent the views of any organization or any other person. These are personal views only.

A lot has been written about the Budget of July 2024 and taxes. While the Budget from the Ministry of Finance is a lot more than just taxes, it does set us thinking about all kinds of incidental taxes apart from infra spends and $30 trillion economy targets. The recent Budget proposed substantive changes to indexation benefits on real estate by removing them initially – subsequently relaxed and made flexible to calculate the option of LTCG at 20% with indexation or 12.5% without indexation for properties purchased before 23 July, 2024; set the trend of an upward tick on LTCG on equities / equity funds (see Table 1); while positively harmonizing the LTCG on gold ETFs/funds.

I do believe that a taxpayer should give back to the nation and it is the taxpayer’s duty for the nation which provides him the necessary infrastructure and security. Also fully agree, we need to support the farm sector…supporting nation-building in any small way is a matter of pride.

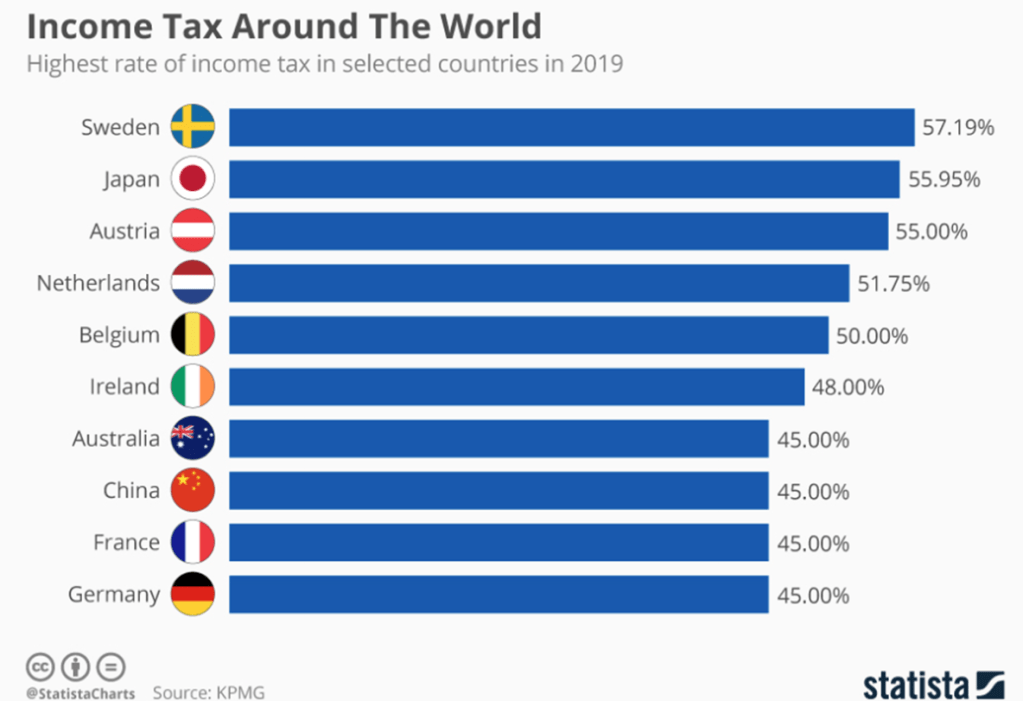

We also need to note and agree that income tax rates in India are at reasonable rates compared to several countries (thankfully!) (see Table 2), including those countries which have a greater taxpayer to population ratio.

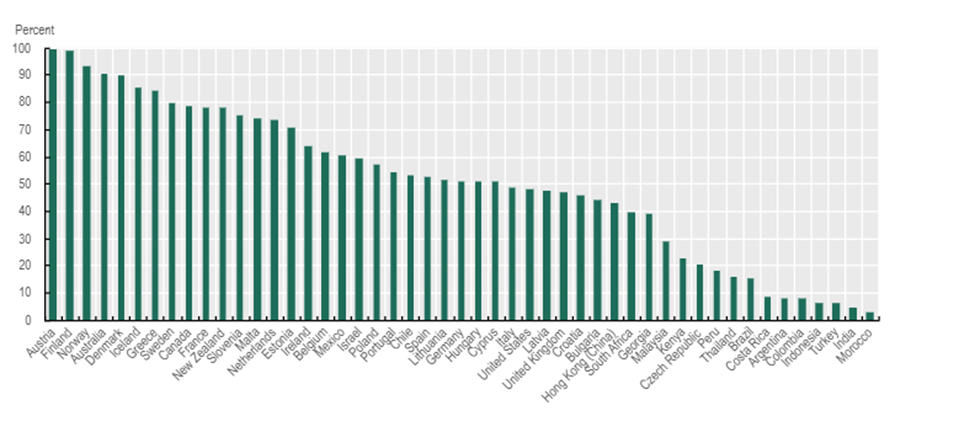

However, we are humans too, and one cannot but think what we get in return…especially, if taxpayers are only c.5% of India’s population (see Table 3), which is a key issue, and there would be significant skewness even within this c.5%. Also note that, this c.5% population pays the Government its highest income (19% of the rupee) even more than corporations, if one excludes borrowing and other liabilities of the Government (Table 4).

Anyways, Taxes are the unchangeable permanence of Life, no point cribbing about it. But, given that we are human beings, and behavioral economics is also a fact of life, here are a few suggestions on rewarding honest taxpayers, i.e., continue to levy taxes such as Income Tax (IT), STT (Securities Transaction Tax), etc., but reward taxpayers as well – the proposal below.

Proposal: Please continue to keep Income Tax (IT), LTCG, STCG, STT, GST (keep adding…) BUT PLEASE GIVE US STTS IN RETURN (Sheegra Taxpayer Tatkaal Services – Easy and Immediate Services to Taxpayers) (see Table: STTS (Sheegra Taxpayer Tatkaal Services) Proposal). Let’s call the proposal STTS / Scheme X :-).

[On a lighter view, the Budget introduced Schemes A, B, C…, I am calling my STTS proposal as Scheme X :-)]

A few constructive suggestions on how we can make Taxpayers feel fully participative and empowered:

1. Speedy processing when availing Governmental Services and ease of access through STTS:

Provide premium processing, quick appointments, and speedy services at Registrar Offices, taluk / tashildar offices, RTOs, civil supplies / PDS, and all Government Offices through STTS (Sheegra Taxpayer Tatkaal Services), as part of STTS Scheme X, per the tax tiers / tax categories (see Table X: STTS / Scheme X, at the start of this page). All applications should be immediately processed within a defined Service Level Agreement (SLA) based on Tax category enshrined in an STTS Act (like RTI Act). Note that this could be a game-changer making taxpayers feel empowered and valued, and help improve revenue recognition and compliance on various fronts. The icing-on-the-cake can also include quick processing and darshan for religious establishments – Imagine an anytime sheegra tatkaal quick-entry to Shri Tirupati Balaji temple, outside of designated closed-door puja hours, with a round-the-clock taxpayer line prioritized by tiered STTS categories such as bronze, silver, gold.

2. Correct the floor and index to inflation:

a. Correct the floor for exemptions for interest income and LTCG: For salaried taxpayers (evidenced by TDS and PF contributions) where salary is the primary income, and for senior citizens, correct the floor for exemptions of income from LTCG and Income from Other Sources (such as accrued interest income) to, say, Rs. 10 lakh to Rs. 15 lakh (which is the current highest income tax slab rate) at current prices. At the minimum, implement this for senior citizens by raising the floor for exempt income from LTCG and other income. [Alternatively provide all senior citizens, including specifically taxpaying senior citizens who may not currently covered by public funded insurance, with substantive health cover that is reimbursable to a point or amount annually (index to the imputed price of a 10-day treatment at AIIMS New Delhi or a similar mechanism). Across states, taxpaying and non-taxpaying, i.e., all, senior citizens should be given health cover, there should be no exclusion based on income; and being a taxpayer should not result in exclusion from basic services to our senior citizens].

b. Index the floor / exemption: Index the floor / exemption limit annually to an inflation index such as CPI and perform repeated cost of living adjustments. One should not expect a ‘budget announcement’ on this.

3. Widen the Tax Base:

Adopt measures to smoothen and lower the tax rates with a vision. Like the fiscal deficit / FRBM targets, the Government could work out a tax coverage and tax base widening target.

a. Enhance GST coverage: Ensure proper billing, GST collections and compliance at all shops and establishments.

b. Enhance the Tax base: While this is being done, the amount of taxpayers is still low as a % of population. Integrating land records, property holdings by PAN, utilization of such land and property, to re-evaluate the tax base could be a step apart from active tax surveillance measures. We do understand the IT Department is using AI/ML tools – Great – But, can this move to publishing a report card of what is being done to widen the tax base and how many people are being brought into the tax paying base annually and a proportionate, relatable reduction in secular income taxes?

As a closing note, Sheegra Taxpayer Tatkaal Services (STTS) is easy relatively easy to implement – the Government has all the data – STTS can be rolled out through e-AADHAR and be made downloadable, and a tax slab linked category in terms of how the above are prioritized and implemented can be worked out – the highest category taxpayer (or a percentile) gets the highest priority and service in Government / Public services, and is implemented through the existing Government tech and / or process infrastructure. Various implementation frameworks can be identified and adopted – the above tier is only indicative.

The Government and the People are in this journey together – both need to understand this. Let us also practice T-E&I – Taxpayer Equity and Inclusion and not just Taxpayer-Existing in Exhaustion (T-EinE).

Just for fun, do hear this masterpiece from Mr. Vijay Kedia – FM ji FM ji Itne Tax Mein kaise bharun (youtube.com) – this is a super song.

Table 1: Tax rates on certain capital assets, per Budget July 2024 for FY2024-25 AY2025-26

Source: https://economictimes.indiatimes.com/wealth/tax/all-about-new-capital-gains-tax-after-budget-2024-stcg-ltcg-tax-rates-holding-period-for-equity-share-debt-gold-property/articleshow/111983877.cms; https://www.indiatoday.in/business/story/nirmala-sitharaman-changes-real-estate-indexation-rule-confirmed-parliament-2578499-2024-08-07

Table 2: Income Tax Rates – cross-section of countries

Source: https://www.statista.com/chart/19734/income-tax-around-the-world/

Table 3: Registration of active personal income taxpayers as percentage of population, 2020

Table 4: Income Tax is the highest Tax component to the Rupee

Source: PowerPoint Presentation (indiabudget.gov.in), Budget presented in July 2024.

Discover more from AnandWrites

Subscribe to get the latest posts sent to your email.